Libor, let’s not blame the bank of England

Published on April 18 2017, John Byrne CEO Corlytics

Last week the Bank of England came under intense pressure following a leaked phone call from Barclays claiming it had been put under pressure from up high, to lower Libor rates. Having an immensely powerful regulatory risk database at my fingers we looked back at the scandal that has been rumbling since 2012.

HARD FACTS

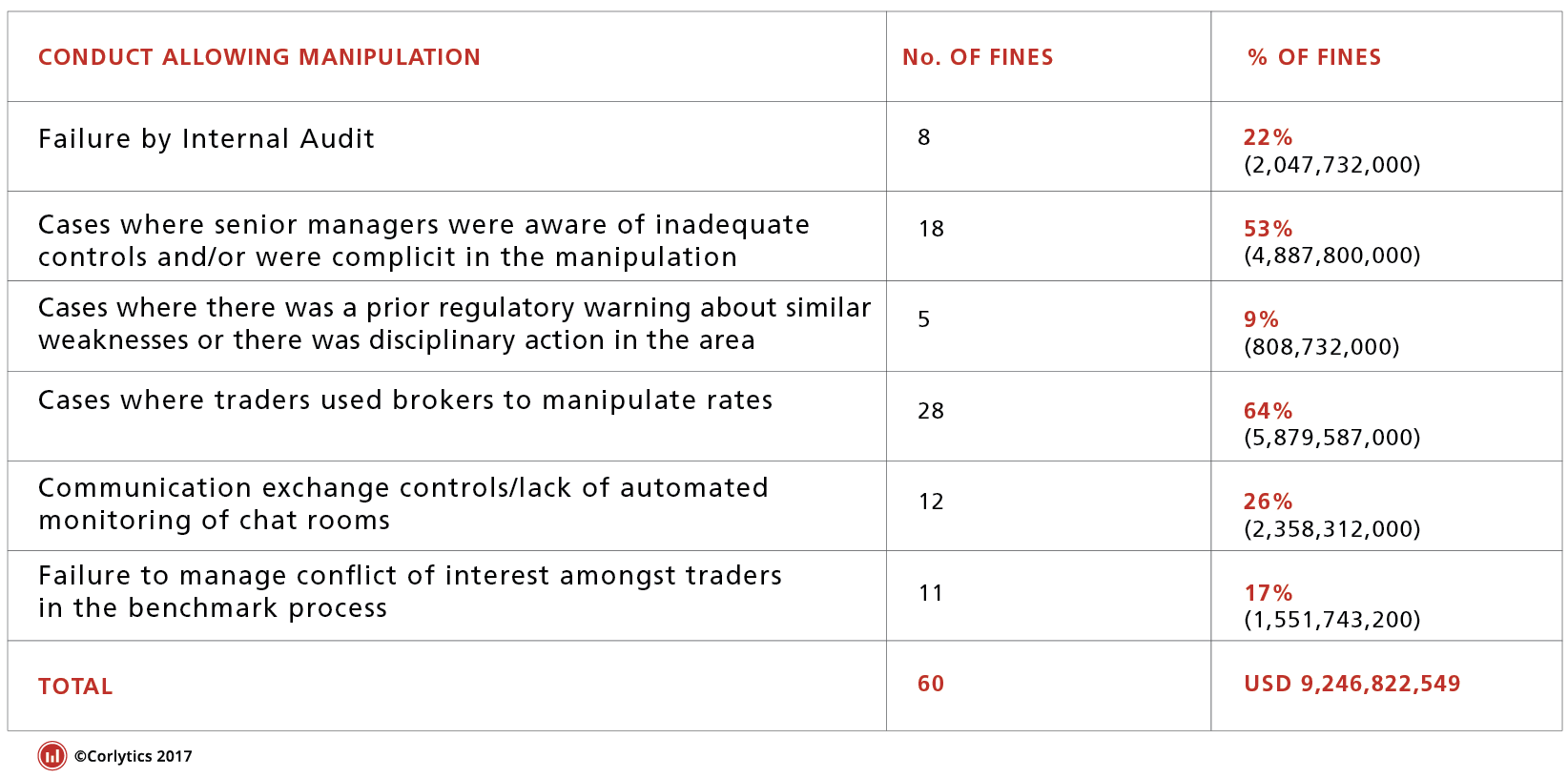

Our global data shows that from 2012 to date there have been 60 fines from seven regulators, involving 13 different institutions totalling more than USD 9.246 billion. With no fines so far this year.

Breakdown of banks’ wrong doings

The Corlytics data shows that more than half (53 percent) of all fines given equalling USD 4.9billion were cases, 18 in total, where senior managers were cited as being aware of inadequate controls and/or were complicit in the manipulation.

The most commonly cited breach (64 percent and 28 fines given), equalling a staggering USD 5.9 billion, was in cases where traders used brokers to manipulate rates.

Warnings for inappropriate action were given along the way. Nine percent of all fines were given in cases where there was a prior regulatory warning about similar weaknesses or there was disciplinary action in the area.

This misconduct took place on average over four to five years. It was prolonged and deliberate. With many cases showing awareness by senior management or indeed collusion on their part.

IN DEFENCE OF THE BANK OF ENGLAND

The Bank of England is primarily responsible for the systemic stability of the UK banking system and its global role within the financial markets. The Bank has always denied allegations it encouraged banks to submit lower readings for Libor.

The investigation into the conduct of various banks, during the Libor scandal, exposed an unparalleled level of wrong-doing.

The Bank of England may have approached the banks to reduce the Libor rates, but:

- Did the Bank of England ask the banks to get their traders to reveal their larger clients’ positions to other traders using instant messaging?

- Did the Bank of England then ask the banks then to collude with other traders, to place bets against their respective client positions?

- Did the Bank of England then ask traders to access and request that the banks’ rate setters, set rates in their favour and against the interest of their clients?

Of course, not.

The reality is that these banks had allowed a lack of controls in important areas that enabled their traders to make a lot of money. This was not just in rigging markets, but in betting against their own clients. The Bank of England cannot be held responsible for that.