Corlytics riding the wave of the growth of the Payments industry

Published on 10th December 2020Corlytics, a global Regtech leader and pioneer in the regulatory analytics space, go live with a number of key global payment clients on their platform this year due to strong global growth in the global payment providers’ sector.

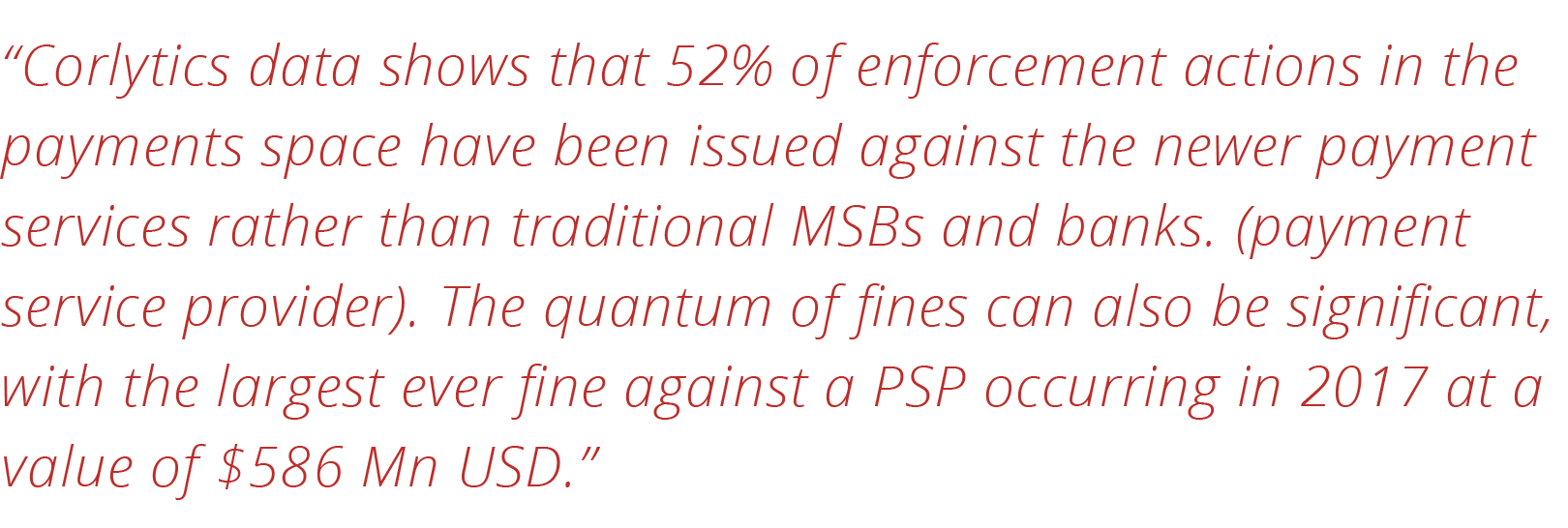

Fuelled by the continued exponential shift from bricks and mortar retail to online retailing, the payment’s sector is experiencing high growth coupled with accelerating regulatory challenges. The financial and payments regulators have become more active in monitoring and regulating these new services and it is these challenges that has seen Corlytics helping firms fulfil their regulatory obligations.

Corlytics, the global leader in regulatory monitoring, obligation management and regulatory risk analytics has grown its market reach from a strong customer base of traditional financial services firms to one that includes these newer payment providers, e-money firms, and FinTechs as their flexible, dynamic solution supports firms’ own regulatory engagement strategies.

There has been a notable increase in the legislative pressure experienced by the payments sector with new requirements to be implemented and acted on in an efficient manner in part due to the payments sector launching new products and services. These regulatory initiatives fall into two main types, those to protect the market and its participants, to avoid both systemic market failure and to provide customer protection, and those that enable innovation and increased competition. The failure of the German payment processor Wirecard, earlier this year, was a big warning to the regulators of potential problems within these types of firms.

The recent Schrems II decision, by the Court of Justice of the European Union (CJEU) has caused additional, accelerated regulatory pressure with the new ruling covering the protection of personal data transferred from the EU to outside the EU. This will have widespread implications for firms handling the personal data of those within the EU, clearly an issue for firms in international payments.

The implementation of Corlytics regulatory monitoring solution, designed to provide real-time automated regulatory monitoring, including horizon scanning and a regulatory library, has the ability to shift the payments industry to a new paradigm achieving higher rates of regulatory compliance while also supporting the move into new product offerings. The incorporation of an impact assessment workflow, utilising AI (artificial intelligence) and ML (machine learning) technologies, offers a highly progressive step in the advancement of compliance for both traditional and more contemporary payments firms.

“Working with some of the leaders in the payments sector has been an exciting development for Corlytics. We see this emerging finance sector as on track to see substantial growth over the next few years and we’re delighted to be able to be a partner in that,” commented Mike O’Keeffe General Manager of Corlytics Solutions. “We’re committed to working with all our customers to help them achieve high levels of regulatory compliance and support their strategic initiatives.”

–END–

For media enquiries contact insights@corlytics.com

Please click here to read our other articles in our news gallery