The impact of COVID-19 on Enforcement

Published on 22nd May 2020RISING PENALTIES

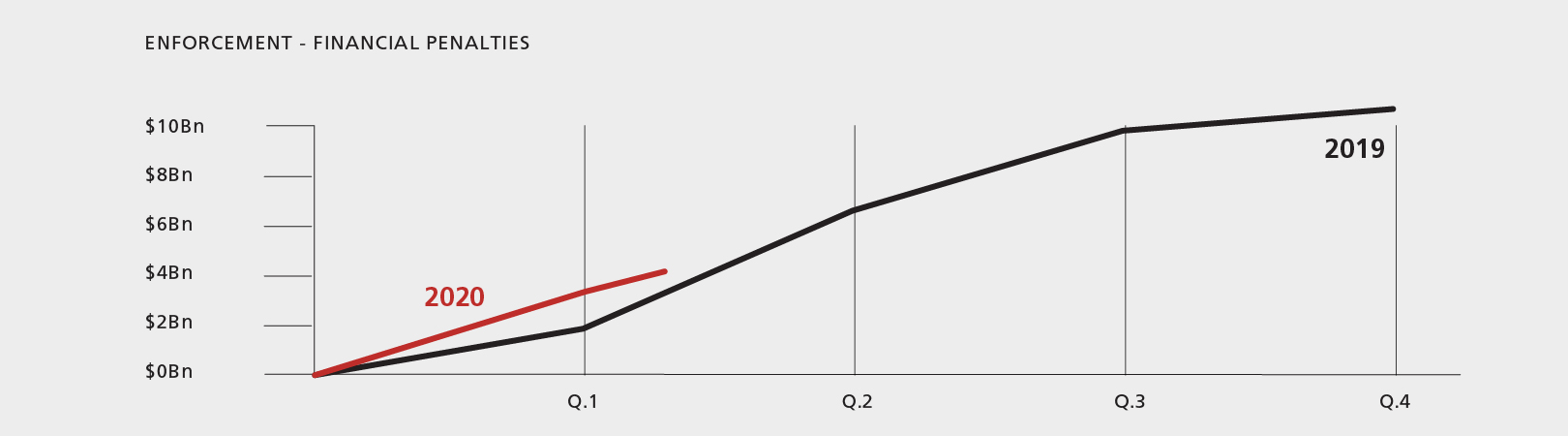

As the global COVID-19 emergency rapidly unfolded around the world in the first quarter of 2020, financial enforcement penalties continued to rise. Corlytics tracked a 50% increase in global regulatory enforcement fines compared to the same period the year before. During the first quarter of 2020, global regulators levied more than $3.1 billion in monetary fines, compared to $2bn in the first quarter of 2019, with no signs of levels reducing into Q2.

ENFORCEMENT DATA 2019 AND Q.1 2020 (cumulative)

“Risk-based supervision and enforcement activity more critical than ever”

FATF (Financial Action Task Force)

DECLINING ENFORCEMENT ACTIVITY

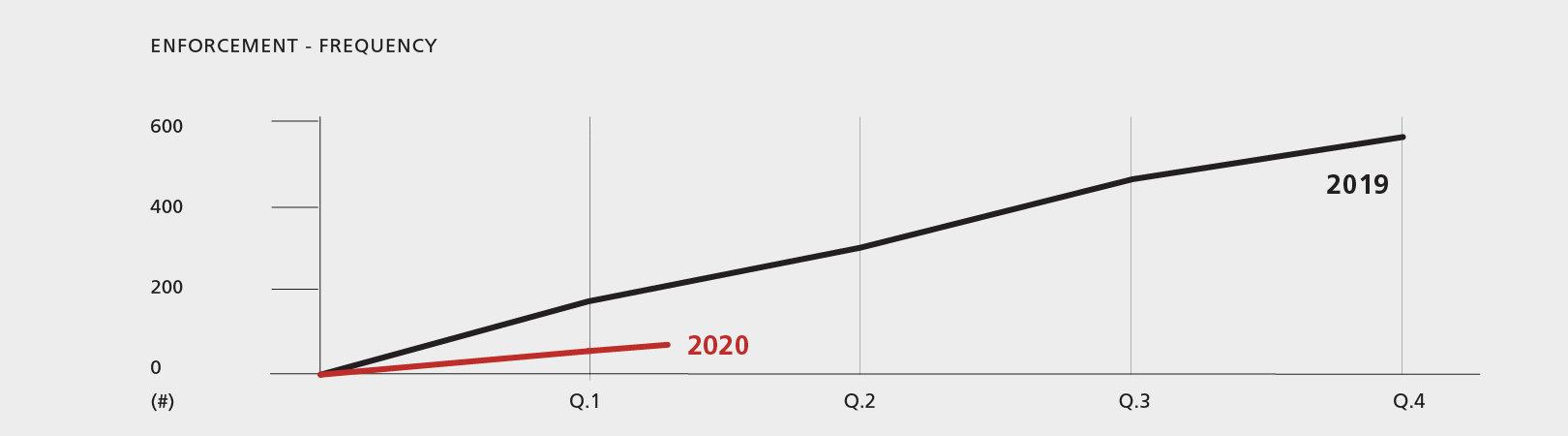

In parallel with the swift response from regulators around the world to reorganise work programs and help manage the impact of COVID 19 on the industry, the overall levels of enforcement activity declined from a quarterly average of 143 in 2019. The number of enforcement actions in Q1 2020 fell by nearly two-thirds from 172 in Q1 2019 to 65 in Q1 2020 with the trend continuing through April.

ENFORCEMENT ACTIVITY 2019 & Q.1 2020 (cumulative)

Regulators in Asia were the first to scale back enforcement activity and the trend is expected to follow in other jurisdictions as regulators reprioritize plans and re-focus their resources. The FCA was clear in its business plan for the year ahead that it expects its work to be fundamentally reshaped by the impact of the pandemic. In practice operational restrictions will also impact logistical aspects of enforcement for all regulators including face-to-face interviews and on-site inspections. ASIC has said that “Enforcement action will continue. However, it is recognised that there may be some changes to the timing and process of investigations to take into account the impact of COVID-19. There will also be changes due to, among other things, constraints created by variations to usual court procedures.”

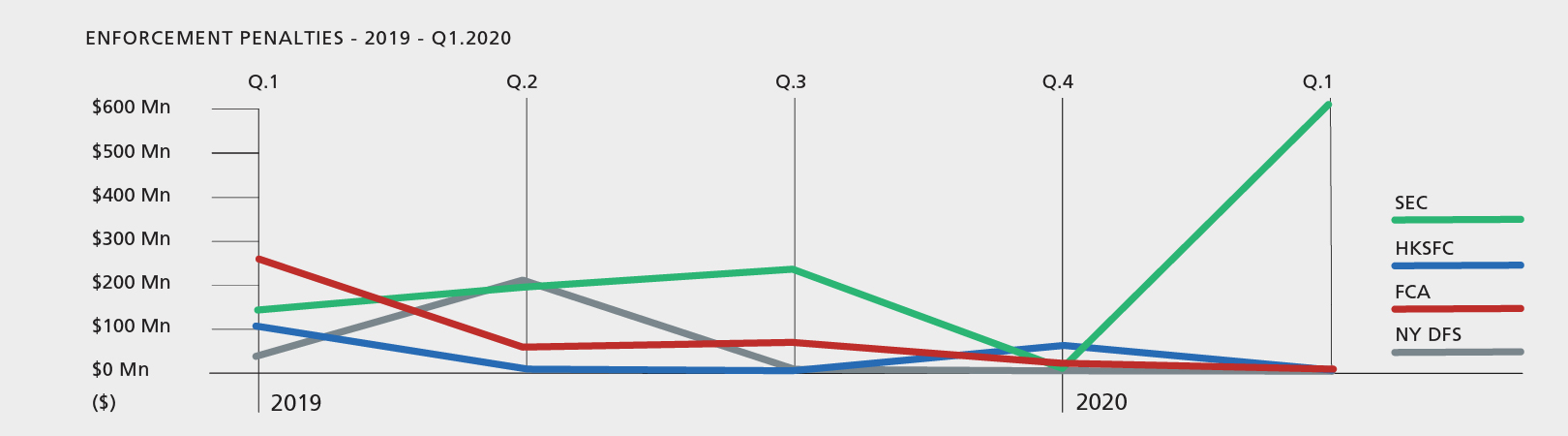

ENFORCEMENT ACTIVITY 2019 & Q.1 2020

Enforcement by Service/Business Lines

FINANCIAL ENFORCEMENT PENALTIES BY SERVICE LINE 2019 & Q1. 2020

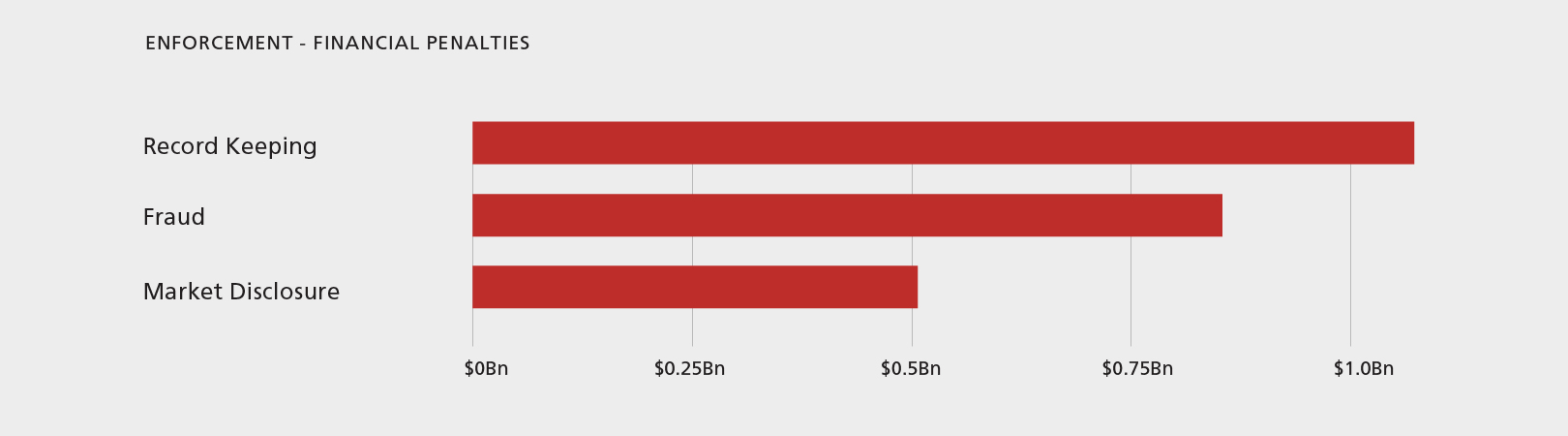

Enforcement by Regulatory Category

THE KEY FAILURES

The three major regulatory breaches underpinning the first quarter surge in penalties were fraud, record keeping, and disclosure to the market. These regulatory drivers of enforcement penalties reinforce the significant and wide-ranging risks that firms need to focus on in the current turbulent environment. They also reflect the increased notices being published from regulators worldwide on new and revised measures and expectations to manage these areas of heightened risk.

For access to the world’s single source of enforcement information please get in touch

FINANCIAL ENFORCEMENT PENALTIES BY REGULATORY CATEGORY Q1. 2020

1. RECORD KEEPING: The sudden and widespread move to remote working has created new and increased risks and challenges around record keeping. Regulators such as ASIC have reminded firms of their continuing obligations around maintaining and supervision records even where staff are working remotely. Acknowledging the practical challenges of meeting some requirements the CFTC has provided temporary relief on call recording but will require written records of oral communication to be maintained. Similarly ESMA recognised that recording voice communications as required by MiFID II may not be practicable in the exceptional circumstances. Alternative measures such as written minutes of telephone conversations may be required but must be temporary and telephone recording restored as soon as possible.

2.FRAUD: The FATF has warned firms that fraudsters are seeking to exploit gaps and weaknesses while they assume resources are focused elsewhere, “making a risk-based supervision and enforcement activity more critical than ever”. The U.S. Treasury’s Financial Crimes Enforcement Network has warned firms of the risks of fraud related to the coronavirus having seen a pattern of scams and insider trading.

3.MARKET DISCLOSURE: The unprecedented market volatility and uncertainty have created heightened risks around disclosure to the market. Whilst regulators are mindful of the practical challenges organisations face, the obligations on firms still apply. The FCA has acknowledged that “coronavirus may create challenges in the convening and operation of disclosure committees but expects listed issuers to make every effort to meet their disclosure obligations in a timely fashion.” ASIC has said that it has stepped up its markets supervision work to support the fair and orderly operation of markets, ensure investors are appropriately informed, and protect against manipulation and abuse.

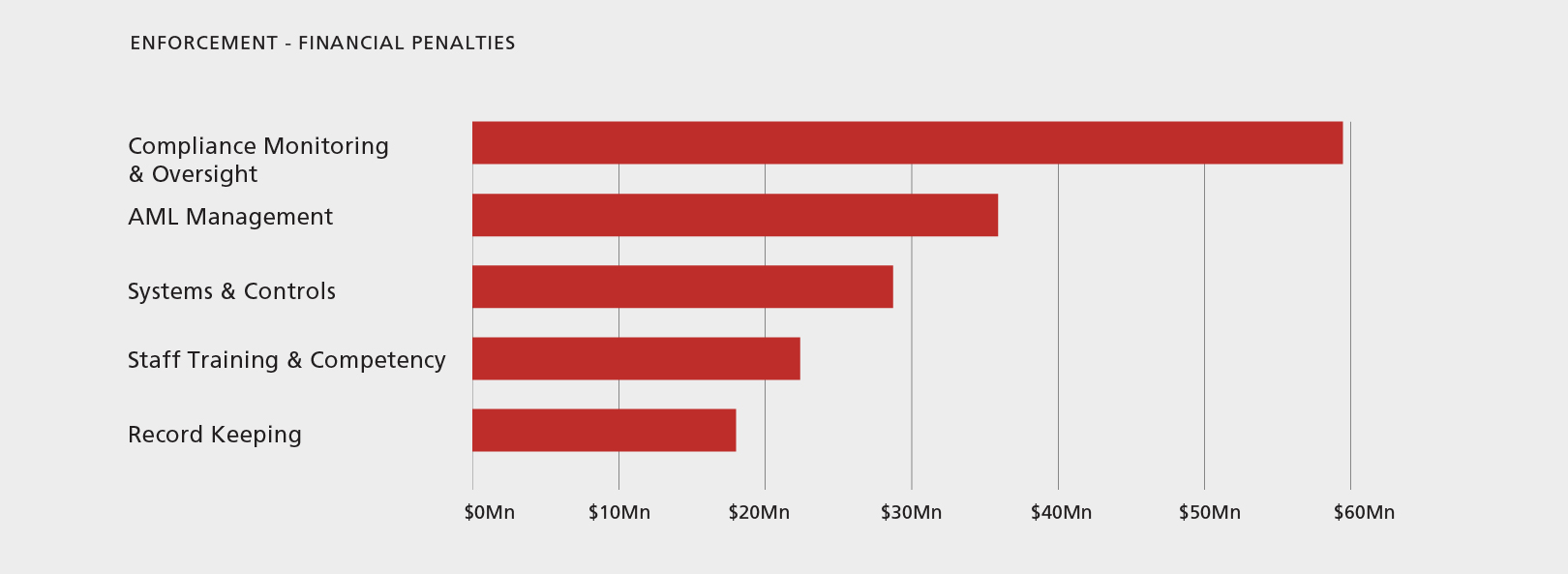

Enforcement by Controls Failings

CONTROL FAILURES CITED IN ENFORCEMENT PENALTIES (Q1 2020)

Control deficiencies are a key factor for regulators in determining the severity of enforcement penalties and multiple control weaknesses were cited by regulators across enforcement actions in Q1. It is now more crucial than ever that compliance teams ensure that both systems and controls are in place and adequate to support revised working environments and practices and that records and evidence of monitoring and oversight are maintained.

Despite the welcome flexibility and support that regulators are providing in these challenging circumstances, from the delayed implementation of international rules such as Basel 3.1 to the extension of consultation deadlines to 1 October, the authorities have made it clear they are also watching firms and will continue to enforce standards. Access to records and evidence of controls and oversight will be more critical than ever for future regulatory inspections and avoiding enforcement action once the global emergency has faded.

Stacey English, Chief Digital Officer