Digital transformation with regulatory compliance plus a taxonomy – why firms need to start their journey

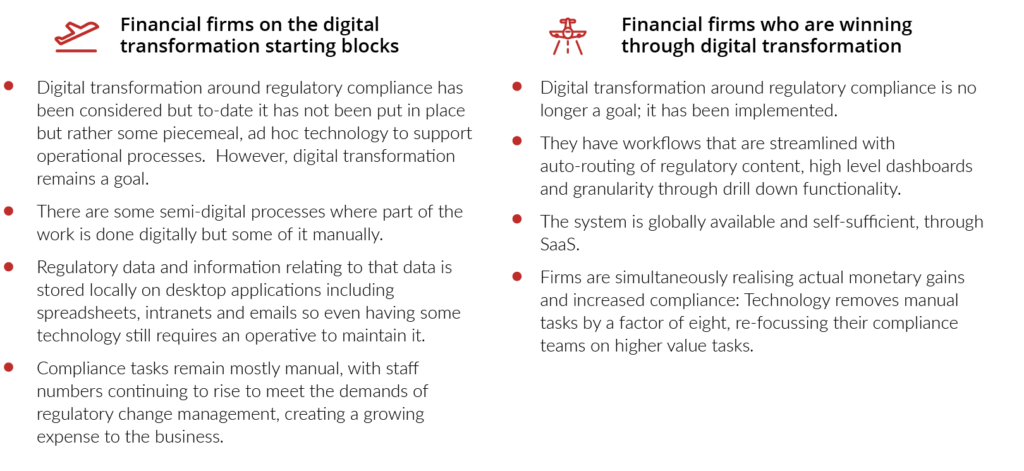

Published on 28th January 2022Most financial services firms have thought about regulatory digital transformation for compliance, but many have not started the journey to implementation or even investigating and planning for this change. In a Garter survey, a year before the pandemic, only 12% of financial services firms were found to be what they described as ‘digital transformers’, a term Gartner uses to mean that they were using digital transformation to create value through: the adoption of new digital business models; employing a highly integrated IT and digital strategy; and teams were structured and operated in a cross-disciplinary manner.

Digital technology is key to any digital transformation approach in regulatory compliance, not only moving towards adoption but using these new technologies for innovative purposes.

Finding the right technology and business partner

Finding the right technology and business partner depends on what your requirements and vision are in relation to regulatory compliance and your digital journey. For regulatory compliance projects with a regulatory technology firm, you need to think about how collaborative an experience it is likely to be and whether your partner has experience working with similar firms. You will want to work with not just a Regtech firm but with the skilled individuals within that firm.

From a technology point of view, a SaaS application will give you synchronous access across all locations plus it doesn’t require local installs. Key to reaching digital transformation is the connection between systems and having a clean workflow, and a vendor with API features in their solution will enable your current systems to connect with the new solution seamlessly.

Then there’s the taxonomy, the way your classification of regulations matches with the single view presentation by a vendor and it’s important that you have a vendor with very strong capabilities in this area.

Corlytics bring a new way of working. We provide a hybrid business partnership model to reduce regulatory risk; that is human experience and empathy coupled with specialist technology shaped by our clients; with unique taxonomised and risk rated regulatory content. We give our clients the ability to manipulate data at a granular level but on an industrial scale providing benefits from cost savings to enforcement avoidance. We develop innovative digital tools to aggregate, taxonomise and risk rate regulatory content giving clients high value data with granular drill down capabilities all on highly visual dashboards.

Please connect with us if you’d like to know more.

* The State of Digital Business Transformation for Financial Services Business-Line Leaders – Gartner