INVESTMENT MANAGERS

Bringing collaboration with order and harmony to investment management regulation projects, with layered stakeholder engagement to include financial, prudential and fiduciary management, needing greater understanding around regulatory obligations and changes

Q. What are your regulatory challenges?

Unable to find and assess imminent and emerging regulatory change effectively. Difficult to identify, analyse and manage all relevant regulation relating to investors, assets and firm despite regulation being a risk.

Q. What makes Corlytics a unique solution?

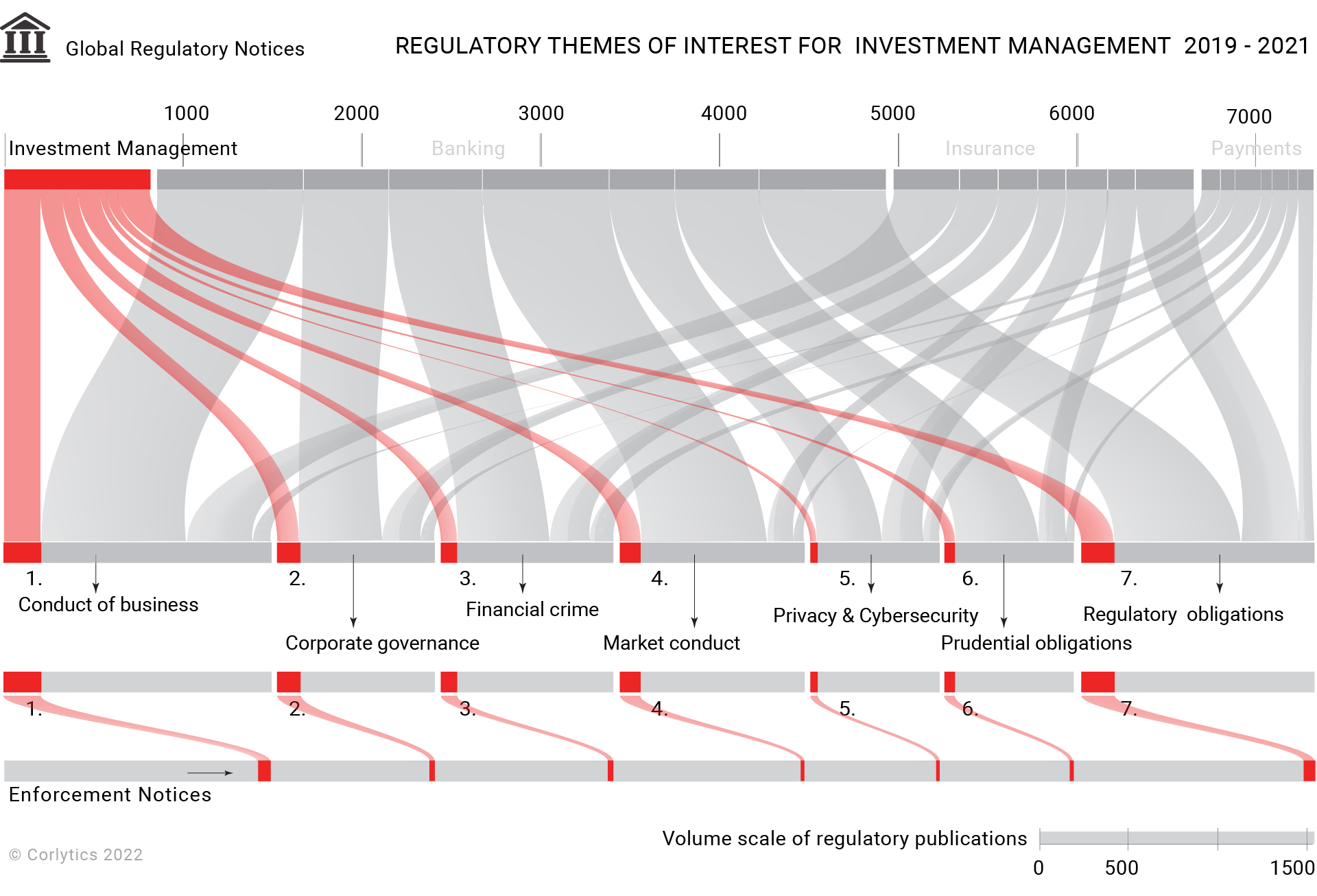

As a strategic business partner, Corlytics monitors all financial services regulatory information, identifying emerging trends, including ESG, and providing a risk rated view of this regulatory content in an easy to digest, fully searchable, immediately usable, digitised format with unique visualised dashboards.

Q. How does it work and why it’s needed?

To monitor and manage regulatory change, Investment management firms are finding that automation and using a single global platform, capturing all assessments relating to the investors, assets, jurisdictions, risks and firm, is helping them with challenges around the identification and management of increasing regulation.

Our solutions for your regulatory needs

Read our case studies

All financial firms have issues with regulatory change management.

These case studies give an account of the needs of different clients and different types of financial firms, with similar regulatory requirements across a range of diverse business lines and geographies.