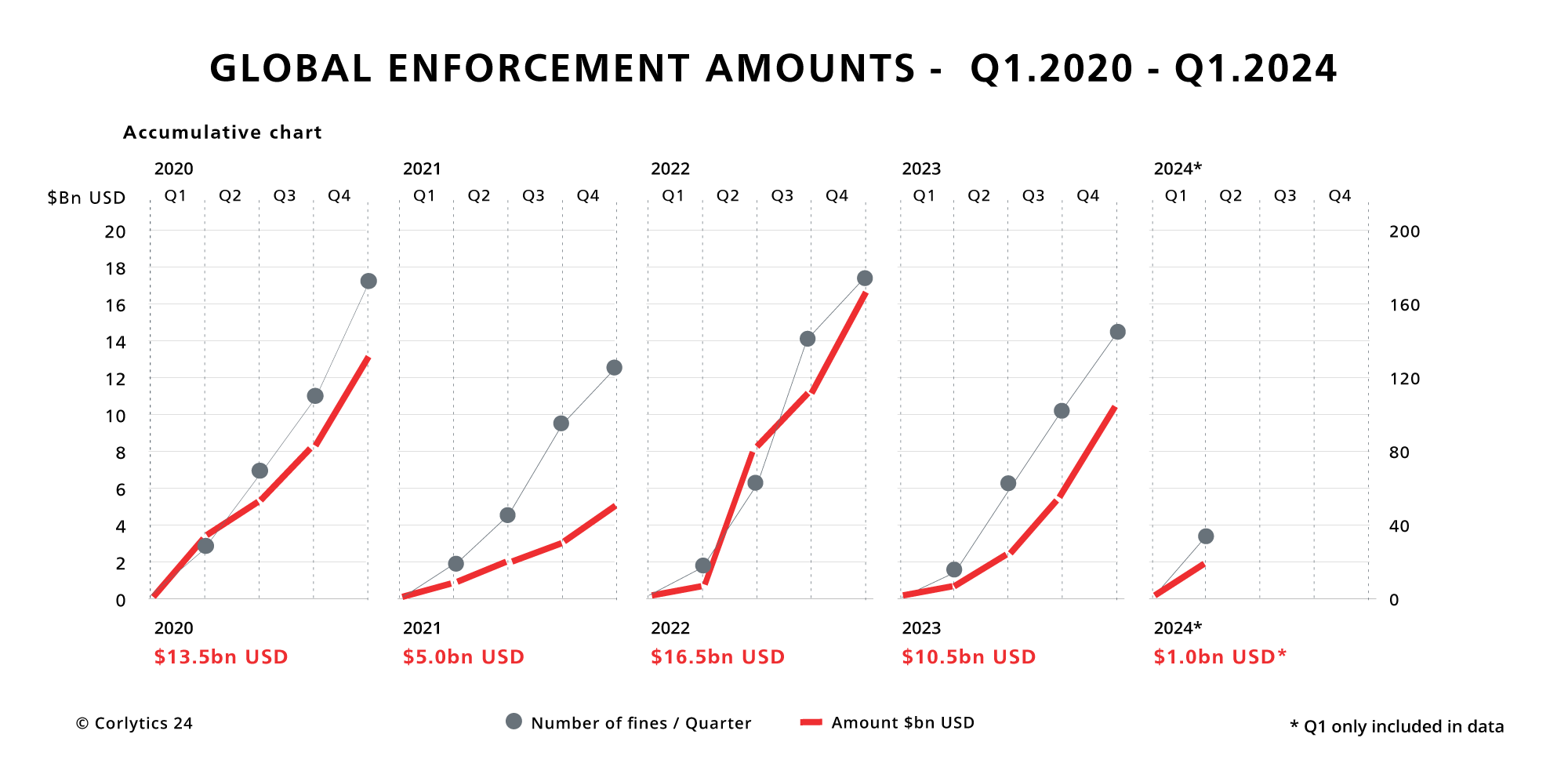

Q1 2024 sees a surge in the amount of fines related to sales and trading activities.

SUMMARY

We’ve seen a high number of fines in the first quarter, both in terms of quantity and quantum. Of note is the surge in the amount of fines related to sales and trading activities. Two of the top five fines relate to JP Morgan’s trade surveillance failures, with both the OCC and Federal Reserve imposing fines totalling $0.35 billion. In the UK, the PRA kicked off the year by imposing its second highest fine ever on HSBC for failing to properly implement the requirements set out in the Depositor Protection Rules. We are also continuing to see regulatory focus in the US on record-keeping failures and use of unapproved communication methods.

Corlytics’ forensic analysis of regulatory data is provided by our team of experts to meet today’s requirement to track regulatory activity across the globe.

We provide quarterly updates of global enforcement analytics and this data is charted by amount, by year, by jurisdiction, by regulatory category, by control failings.

If you would like to receive this enforcement chart, please complete the form below or send us an email to insights@colytics.com

Global Enforcement Data 2023

Get in touch with us if you would like to see the enforcement reports for 2022 or for Q1 and Q2 of 2023