Maintaining Regulatory Compliance: The Value of Risk Rated Regulatory Content

Published on 31st August 2022In recent years, the regulatory environment has become more complex and challenging. This is due in part to the increased volume of regulatory requirements, as well as expanding expectations on regulatory reporting. Financial firms have been caught up in regulatory fines and enforcement actions over recent years with Corlytics Enforcement Data illustrating that there has been over €75Bn in fines since 2017. The cost of regulatory non-compliance can be enormous for a financial institution: fines for failure to report or maintain accurate financial records can reach millions of dollars per violation. Corlytics data shows that the average fine amount over the past 5 years is €2Mn, highest fine amount is €6.5Bn, Deutsche bank)

INCREASING BURDEN OF REGULATORY REQUIREMENTS AND GREATER EXPECTATIONS ON REGULATORY REPORTING

One of the many challenges facing financial firms is the increasing burden of regulatory requirements, as well as expanding expectations on regulatory reporting. The need to stay on top of these changes has led many companies to invest in risk-rated regulatory content and analytics tools that help them understand and manage their regulatory compliance risk and obligations.

The value of risk rated data lies in helping you demonstrate your compliance with key regulations. It can also help you identify areas where there may be gaps in your knowledge or understanding so that you can focus resources on addressing those issues before they become a problem later down the road.

THE COST OF REGULATORY NON-COMPLIANCE

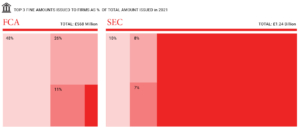

A sample of two regulators and the fines they issued in 2021, one UK regulator and one US regulator.

FCA 2021 GBP £568Mn

SEC 2021 USD $1.45Mn

But if we drill down into these fines some become very notable by their high values.

Values in this chart are in £GBP

FCA

- NatWest – £264.8 Mn, FCA fine for breaching money laundering regulations

- Credit Suisse – £147 Mn, FCA fine relating to financial crime and anti-bribery

- HSBC – £63.9 Mn, FCA fine for breaches in the money laundering regulations

SEC

- JPMorgan Chase – $125.8 Mn (£107 Mn), SEC fine for breaches in corporate governance regulations

- Credit Suisse – $99.0 Mn (£84.3 Mn), SEC fine for breaches in financial crime regulations

- TIAA-CREF – $97 Mn (£82.6 Mn), SEC fine relating to conduct of business breaches

In addition to these financial penalties, companies must also consider how their failure to comply with regulations will affect their brand image and reputation among consumers who may purchase from them in the future—a concern that doesn’t go unnoticed by executives at many organisations who are tasked with ensuring compliance throughout all aspects of business operations.

THE CASE FOR RISK-RATED REGULATORY DATA

Although regulatory compliance is an area of focus for many firms, it can be difficult to measure. Some companies may not have the resources or expertise to comply with a large number of regulations. The difficulty in measuring regulatory compliance means that regulators often have little insight into how well firms are complying with their rules and regulations.

Risk-rated data helps companies understand their own risks, as well as those of others who operate within their industry environment (e.g. competitors). By understanding these risks and comparing them against each other in a consistent manner across industries, firms can make informed decisions about how they should manage those risks through processes such as risk management plans or third-party auditing.

REGULATORY RISK DATA ENHANCES AND INFORMS THE BUSINESS

Regulatory risk data can help enhance operational effectiveness, inform strategic planning and transform general compliance processes and management.

Firms can manage regulatory risk by using their regulatory information to improve the performance of their operations. This can be done through:

- Performance improvement strategies that are tailored to specific business units or functions;

- Identifying weak links in the chain of custody (e.g. an employee who has been identified as non-compliant); or

- Using detailed data on individual customer identities, including but not limited to demographics and lifestyle factors

Corlytics has spent over a decade analysing regulatory action and penalties levied on global firms by regulators all over the world. It has developed a proprietary risk rating methodology utilising AI.

It has never been more important for financial institutions to be in control of their regulatory risk.

The regulatory burden is increasing, and financial institutions are being caught up in regulatory fines at an alarming rate.

CONCLUSION

The importance of regulatory risk management is growing. Regulatory compliance is no longer a one-off cost; it’s an ongoing cost that must be carefully managed. Risk-rated data can help your firm do this.