Westpac’s “Wake Up Call” – with more to come from AUSTRAC

Published on 24th October 2020By Iain Telford, Legal and Regulatory Analyst.

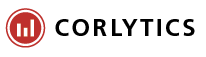

On 24 September 2020, the Australian Transaction Reports and Analysis Centre (AUSTRAC) announced that it had reached an agreement with Westpac Banking Corporation (Westpac) in a proposed $1.3 billion (AUD) civil penalty.

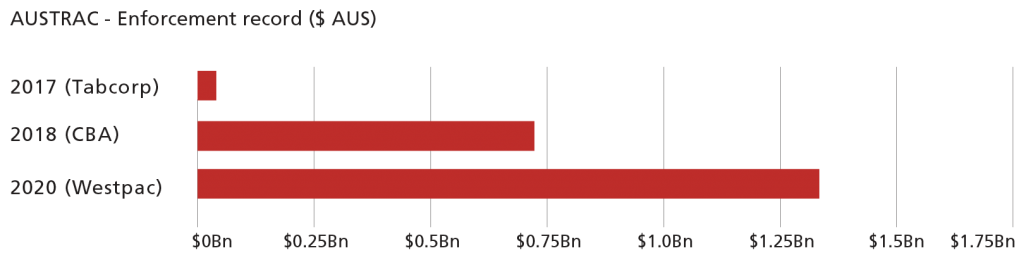

The proposed settlement follows a year-long AUSTRAC investigation into admitted but unintentional contraventions of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) by Westpac in relation to the non-reporting of over 23 million payment instructions.*See footnote[1]

If approved by the Federal Court, the penalty will represent the largest civil penalty in Australian history, a jurisdiction that has seen rapidly accelerating fining activity over the past 3 years.

AUSTRAC’s actions indicate a need for institutions to ensure strict compliance with AML/CTF laws to protect citizens from criminal activity.

The most recent proposed penalty highlights the (increasingly expensive) consequences for firms found to be in violation of such laws – and AUSTRAC is not finished yet, with Chief Executive Nicole Rose indicating that a major non-banking institution is in their sight this financial year. While she may have been referring to the recently announced inquiry into Crown Casinos, it also displays a determination to highlight the focus that the Australian regulator continues to have on AML/CTF.

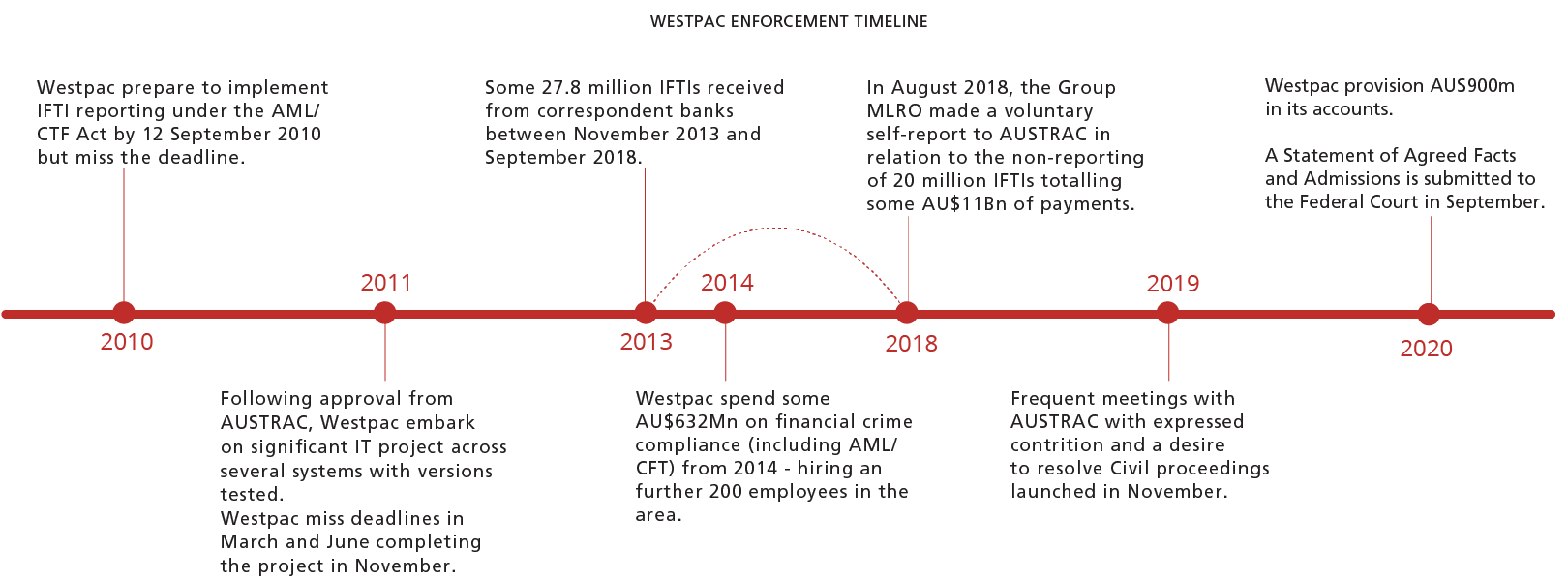

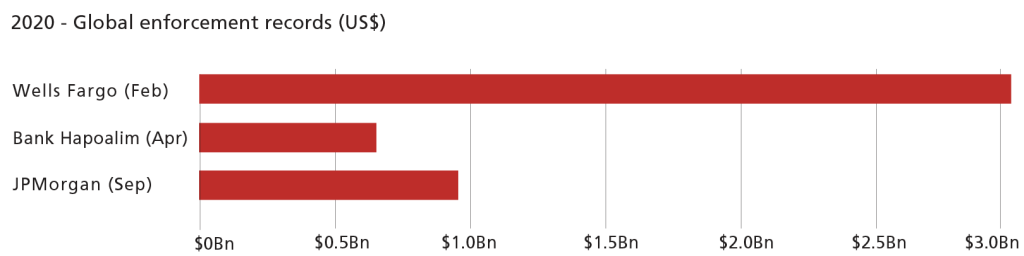

This pattern of continuing to levy high fines is something Corlytics is increasingly seeing on a global scale, and, in general, there are no signs that the COVID-19 pandemic is reducing the size or pace of fining.

In fact, the Commodity Futures Trading Commission (CFTC) announced a record-breaking year in the agency’s Division of Enforcement – and there is no indication of such enforcement activity slowing in 2021, with CFTC Chairman Heath P. Tarbert stating “we are tough on those who break the rules …”

CONCLUSIONS

There is growing appetite on the part of global regulators to ensure that firms are seen to suffer severe penalties when they breach legislation or regulation. The focus of regulators has been on ‘bread and butter’ elements of their business, where, even if firms did self-report, remediate, or seek to rectify, a strict liability approach is taken but with larger penalties. The Australian AG said the Westpac settlement is a “wake up call” but global regulators are flexing their muscles across the board and the regulated firms will need to set their alarms earlier.

A special thanks to our Legal Interns Emer Rafferty and Lauren Dunne for their contribution.

Footnote:

*[1] “The contraventions were not a consequence of any deliberate intention to contravene the AML/CFT Act. At all times, the Westpac Board and senior management sought to ensure that Westpac would comply with its obligations” (SAFA p.69 paragraph 358)