_______

REGULATORY MONITORING

CORLYTICS DIGITAL ASSETS REGULATORY CHANGE MANAGEMENT

Keep apace with emerging regulations and regulatory changes for digital assets

The Corlytics Digital Assets Regulatory Change Management solution enables the identification and assessment of the impact of emerging digital asset regulations, and changes to existing regulations (for example, financial crime regulations) that will impact your business. The solution helps firms with Digital Asset products to managing the huge volume of regulations and regulatory changes that are flooding this space. Firms operating digital assets, crypto assets or tokenised products are clearly in the sights of the regulators, with regulatory regimes being developed including the EU regulatory framework MiCA, the recent US Presidential executive order on ‘Ensuring responsible development of digital assets’, as well emerging regulation in financial services strongholds such as Singapore.

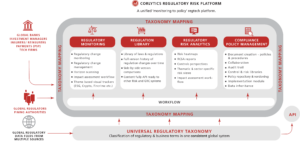

The solution provides a centralised and automated global content store of both regulations and regulatory changes that are published on a day-to-day basis, with workflow capabilities to carry out mapping to policies and controls and impact assessments in a single location. The platform enables collaboration, sharing and the sharing of responsibility and accountability across departments – essential for compliance and obligations management.

The solution is easy to deploy, integrates seamlessly with other Risk or GRC systems in your firm, through industry standard rest-based APIs, and has high usability and familiar user layouts for search.

ENSURE COMPLIANCE: The solution provides you with the full set of regulatory obligations with which you must comply, as per existing laws and regulations in each market in which you operate, and also to those in which you wish to expand. Identify imminent risks for assessment and by centralising and standardising the impact assessment process across multiple jurisdictions.

LESS RESOURCE TO MANAGE REGULATORY CHANGE: As many financial services firms are aware, an explosion in obligations has meant an explosion in the number of compliance officers on the team. Hiring of staff cannot continue apace with exponentially growing regulatory changes. The Corlytics solution enables firms to do more with the same staff. Corlytics automates the manual tasks associated with regulatory change management providing very significant efficiencies.

SPEED TO COMPLIANCE IN NEW PRODUCTS AND MARKETS: Owing to Corlytics extensive library of laws and rules across global regulators, Corlytics can enable firms offering digital assets to becoming compliant upon entering a market, ensuring that you have all obligations with which you need to comply at your fingertips, even before your license to operate in that market is granted.

EASY INTEGRATION & USE: Fast to deploy and easy to integrate to existing capabilities within the firm, with high usability and familiar user layouts for search.

INCREASING TRUST IN DIGITAL ASSET PRODUCTS: With increased scrutiny of digital assets products and services, firms can prove that they are compliant with regulations to their customers, both business to business and business to consumers. Illustrating compliance with regulations will help illustrate that your firm can be trusted and will encourage adoption of your products and services, making compliance a competitive advantage over those who are not focussed on compliance.

REDUCES RISKS: Identifying emerging digital/crypto asset risks over the horizon and by analysing the initiatives of international bodies who are setting the agenda for future regulation.