Financial Crime and Covid-19

Published on 26th June 2020Iain Telford, Legal & Regulatory Analyst

The Covid-19 pandemic has dealt a harsh blow to the global economy. The full extent of the human and economic impact of this crisis will remain unknown for some time, but already we have observed the profound impact on financial institutions and the way they operate. Banking firms have introduced loan payment moratoria and other measures to help relieve financial strain on households and businesses. Workforces have been moved to remote working environments and restrictions on the movement of people and goods have modified the demand for products and services across the financial sector. These factors combined have opened the door for criminals attempting to exploit firms and individuals for financial gain.

EXPLOITING THE SYSTEM

The U.K. Financial Conduct Authority (FCA) has urged firms to remain vigilant to criminals taking advantage of the Covid-19 pandemic to carry out financial crimes. Insider trading, fraud, money laundering and cybercrime pose some of the most significant threats to the stability of the financial system.

INSIDER TRADING

The Securities and Exchange Commission (SEC) warned against fraudulently trading on non-public information related to the Covid-19 pandemic. Changes forced by the pandemic, such as financial reporting extensions, could result in corporate insiders obtaining material non-public information that may hold greater value than under normal circumstances. The SEC has reminded such individuals of their obligations to keep this information confidential. The Financial Crimes Enforcement Network (FINCEN) announced that it has received reports regarding suspected Covid-19 related insider trading. Furthermore, the Financial Industry Regulatory Authority (FINRA) has stated that it will be focusing on monitoring for fraud and other illicit activities.

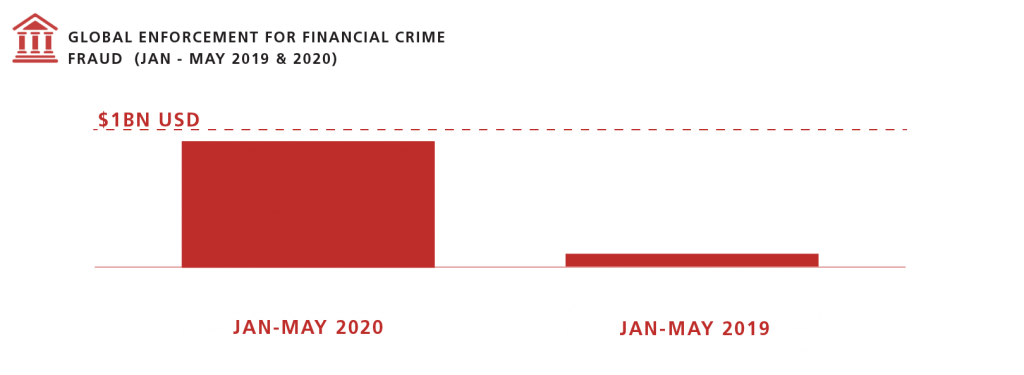

These regulatory warnings are not without merit. During the first quarter of 2020, Corlytics tracked a 50% increase in global regulatory enforcement fines compared to the same period in 2019. Here’s how enforcement actions for Fraud featured in this 2020 surge:

Interestingly, global regulatory enforcement fines for Insider Trading in 2020 are comparatively low (+$800,000) but we may see an increase in these figures in the aftermath of the pandemic and amid regulatory warnings.

MONEY LAUNDERING

The Financial Action Task Force (FATF) published a report identifying the money laundering and terrorist financing risks that have emerged during the pandemic. These include criminals bypassing customer due diligence (CDD) measures, the increased misuse of digital financial services and virtual assets to transfer and hide illicit funds, exploiting economic stimulus measures and insolvency schemes, and the exploitation of Covid-19 to move into new cash-intensive and high-liquidity lines of business. The FCA also warned against those attempting to launder criminal proceeds or finance terrorism by exploiting weaknesses in firms’ systems. Furthermore, the Hong Kong Monetary Authority (HKMA) issued an industry letter on Covid-19 and Anti-Money Laundering and Counter Financing of Terrorism (AML/CFT) measures, emphasizing the global reach of financial crime activities. Corlytics’ data highlights the impact of Money Laundering in global regulatory enforcement fines:

CYBERCRIME

Remote working arrangements have also introduced new financial crime threats. Firms may be unable to use traditional methods of customer identify verification, and this may be an opportunity for criminals to commit cyber-enabled fraud. The FATF recently released Guidance on Digital ID, which highlights the benefits of trustworthy digital identity for improving the security, privacy and convenience of identifying people remotely for both onboarding and conducting transactions while also mitigating money laundering and terrorism financing risks. FINRA has advised firms to remain vigilant to the increased risk of cyberattacks due to remote offices or teleworking arrangements. Firms are urged to be observant of cyber threats and take steps to reduce the risk of cyber events. These steps include: (1) ensuring that virtual private networks (VPN) and other remote access systems are properly patched with available security updates; (2) checking that system entitlements are current; (3) employing the use of multi-factor authentication for associated persons who access systems remotely; and (4) reminding associated persons of cyber risks through education and other exercises that promote heightened vigilance. Despite the operational challenges faced by firms during Covid-19 and remote working arrangements, the FCA has stressed that they should refrain from changing or switching off current transaction monitoring triggers, or sanctions screening systems, for the purpose of addressing operational issues. The European Union Agency for Cybersecurity has also released its Top 10 cyber hygiene tips for SMEs during Covid-19 pandemic.

OPERATIONAL ISSUES

Corlytics has effectively tracked emerging operational issues during the pandemic, with Anti-Money Laundering (AML) Management and Suspicious Activity Monitoring featuring prominently in financial crime control failings:

Overall, financial crime has been a growing trend during the Covid-19 pandemic. In the first five months of this year, Corlytics has analysed over 50 enforcement actions and over 90 regulatory notices arising from financial crime activity. The United States was the most common jurisdiction for financial crime enforcement action, and U.S. regulators published the most regulatory notices citing financial crime categories.

As the effects of the Covid-19 pandemic continue to unravel, the financial services industry will need to be united in the fight against financial crime and market abuse risks. Corlytics’ RegTech solutions can help firms identify these risks and shape their compliance and risk mitigation actions to ensure the safety and soundness of the financial system.

Please do contact us if you would like more information about us and our regulatory risk solutions.